Download Your Copy Here:

SFFS Economic Review_Apr 25

Key takeaways

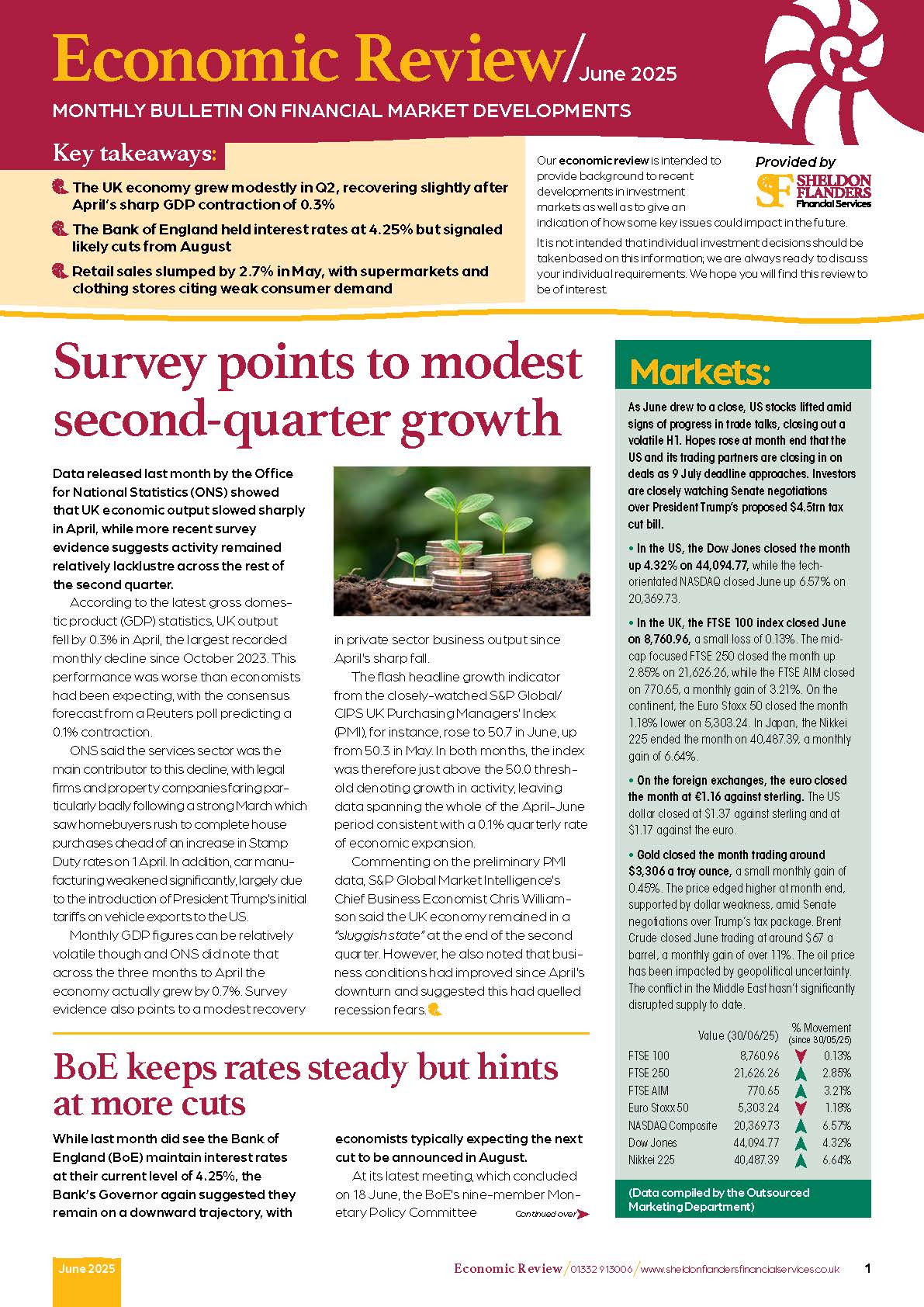

- The UK economy grew 0.5% in February, driven by strong service and manufacturing sectors despite looming headwinds

- Inflation dipped to 2.6% in March, but April’s household bill hikes are expected to reverse the trend

- The labour market weakened as vacancies fell, though wage growth remained robust amid cost pressures and job cuts

UK economy returns to growth

Data released last month by the Office for National Statistics (ONS) showed economic growth was stronger than expected in February, although more recent survey evidence suggests this pick-up may prove short-lived as economic headwinds threaten growth prospects.

According to the latest gross domestic product (GDP) statistics, economic output rose by 0.5% in February, the fastest rate of expansion in 11 months. This figure was higher than all forecasts submitted to a Reuters poll of economists, which had pointed to a monthly rise of just 0.1%.

ONS said this stronger-than-expected performance partly reflected robust service sector growth, with computer programming, telecoms and car dealerships all performing well during February. In addition, ONS noted that manufacturing, electronics and pharmaceutical businesses all enjoyed a strong month.

Separately released trade figures for February also showed goods exports to the US hit their highest monthly level since November 2022. Analysts suggested the jump was a clear sign of firms trying to beat the imposition of President Trump’s tariffs.

Survey data, however, shows that those tariffs are now having a detrimental impact on business activity. Last month’s preliminary headline growth indicator from the closely monitored S&P Global/CIPS UK Purchasing Managers’ Index (PMI), for instance, fell to a 29-month low of 48.2 in April, down from 51.5 in March. This left the index significantly below the 50.0 threshold, denoting a contraction in private sector output.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “The disappointing survey reflects the impact of headwinds from both home and abroad. The biggest concern lies in a slump in exports amid weakened global demand and rising global trade worries, but higher staffing costs have also piled pressure on companies – linked to the National Insurance and minimum wage changes that came into effect at the start of April.”